Late last year, The New Humanitarian began Drought Diaries, an award-winning series tracking how climate-linked food price rises affected six families in three countries – Kenya, Somalia, and Zimbabwe.

For six months, up until April this year, we checked in on our selected families to see how they were coping. They generously allowed us to monitor their basic expenditure, pry into their salary packets, and then quiz them on what had happened in their lives that month.

But the diaries quickly became less about weather, and much more about the broader political economy of each country.

Then, at the very end of the series, we felt the rippling effects of COVID-19 lockdowns as governments responded to the pandemic with movement restrictions and enforced social distancing – measures that have disproportionately hurt the urban poor.

Read more → Are warnings of a COVID-19 famine in Africa overblown?

So, we’ve gone back to the families to understand how they have survived the economic shock of COVID-19 – a crisis so deep it could push the continent into its first recession in 25 years.

Kenya

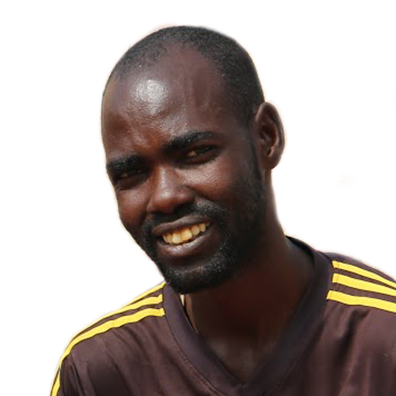

Benjamin Galwaha runs a small shop in the dusty northern town of Laisamis, on the highway to the Ethiopian border.

By March he was feeling the COVID pinch. Food prices were rising as road transport slowed, he had no new tenants for the rooms he let out at the back of his shop, and the livestock market – where he hoped to make a few sales from his goat herd – was closed by government order.

“Let us just wait and see, I hope this [crisis] is going to end soon,” was his guarded assessment that month.

By August, though, Galwaha felt he had seen the worst of it. Shop sales were still low, and the livestock market still shut, but he had found tenants for his rooms – crew from a road building project passing through Laisamis.

Another plus is that food prices have fallen sharply across Kenya as a result of a good harvest. In August, Galwaha was paying 60 percent less for his staple maize meal than in April.

Several surveys have explored the urban impact of COVID-19 in Kenya, see here and here.

Carol Sakwa, head of programmes at Shining Hope for Communities, a Kenyan grassroots NGO, said that despite the easing of the lockdown in July, the “lives of people are not improving so fast”.

The “improvement is like 20 percent”, she told TNH. “Most people are trying to find jobs, and jobs are not forthcoming so people are still struggling.”

Kenya’s rural areas have not escaped the economic impact of the coronavirus either.

Two thirds of farmers said in an August poll that they were selling less produce, employing fewer people, and, as a result of higher input costs, cutting back on investments.

Of those with an outstanding loan, about half said they weren’t confident they could make the next instalment.

But although the government began to ease the lockdown in July, some restrictions remain. For life to return fully to normal, “the president [needs] to open up all the public spaces”, said Galwaha.

A dreadlocked Marlvin Mwaura, the main breadwinner in our second Kenyan family, shares some of Galwaha’s cautious optimism.

In March, he moved from Nairobi to the port city of Mombasa for a much better paying job as a shipping clerk, after months of trying to build the family’s butchery business.

But Mwaura’s work hours and salary had been cut by July due to the downturn in international trade – and he was owed back pay.

He is hoping the economy will rebound. “Things were great in April, and I look forward to things going back to the way they were,” he told TNH.

See Benjamin and Marlvin's budgets:

Benjamin Galwaha, Farmer and shopkeeper

Marlvin Mwaura, Butcher

Zimbabwe

There was far less confidence among the two Zimbabwean families.

Drought and economic collapse threaten 8.6 million people – 60 percent of the population – with hunger by the end of the year.

An aggressively policed COVID-19 lockdown has been an additional burden, shutting markets and small-scale businesses in what is an overwhelmingly informal economy.

Ganda Farayi, a forklift driver, has struggled throughout the drought diary series to make ends meet as inflation ticked past 800 percent – the result of successive years of poor rains and a far longer history of government economic failure.

In March, he finally gave up on the city and headed to his rural home in Wedza, 130 kilometres south of Harare, where life is far cheaper – with no electricity or gas bills to contend with, and free food from his farm.

In an opinion poll in August, three quarters of Zimbabweans said they earned less now than a year ago. With inflation running at more than 800 percent, the majority reported they could not afford all the food they bought only a week previously.

Zimbabweans endured an aggressive lockdown, with free movement to urban centres banned, and travel only authorised for people carrying letters of permission from their employers. The measures effectively shut down the major informal markets on which most Zimbabweans rely on to buy and sell.

Those restrictions were eased in August, and “people are trying to recover from the losses they incurred”, said Chido Marimira of Danish Church Aid, an international NGO that runs an e-voucher scheme for 112,000 vulnerable people in three informal settlements.

”People can now engage in vending activities,” Marimira told TNH. “But they are starting slowly, with only small amounts for sale.”

Now, with the easing of the lockdown, he’s back in Harare to take up part time work with a freight company. But “the situation remains very unpredictable”, he told TNH. “Some days I earn good money, some days nothing, [so] there is really no uptick.”

His deepest regret has been the inability to keep his son – a straight-A student – in secondary school. Unable to pay the fees, his son’s dream of a place in university is over.

In rural Seke, 50 kilometres south of Harare, Loveness January, a widowed mother of two, is also worried about the future.

The family has finished the last of the maize grown on their small plot, and since September they have had to buy commercially.

A first aid assistant at a nearby solar company, January already spends practically her entire salary on food. “It’s not even enough to buy all the food we want – we just buy the basic essentials,” she told TNH. “I don’t even remember the last time I bought clothes.”

The good news is that one of her sons now has a job in the same solar company – doubling the family’s income.

And like Farayi, January is paid in US dollars – a vital buffer against inflation. So, while in local currency terms her household costs increased by 25 percent between April and August, the rate of devaluation means she is still far better off – at least for now.

See Ganda and Loveness' budgets:

Ganda Farayi, Forklift operator

Loveness January, First aid officer

Somalia

Somalia’s humanitarian crisis is a complex mix of conflict and climate change-linked displacement, exacerbated by a major locust outbreak and devastating floods earlier in the year.

The lockdown has been an additional hardship, introduced even though there have so far been fewer than 3,400 COVID-19 cases nationwide.

The annual hajj pilgrimage to Saudi Arabia in July is when Somali livestock breeders, traders, and exporters make most of their money, supplying millions of animals to the kingdom.

This year, as a result of COVID-19, the Saudi authorities all but cancelled the religious event – and that has had a major knock-on effect on the Somali economy.

Livestock makes up three quarters of total exports, with Saudi Arabia the biggest customer. As a result of the crash in sales, livestock prices have halved. “It is significant not only for the families but for the entire value chain,” said Hajir Maalim of Action contre la Faim (Action Against Hunger), an international NGO.

An estimated 40 percent of Somali households are also supported by remittances, and that flow of money – valued at between $1.3 and $2 billion, or roughly a third of GDP – has similarly been affected by the coronavirus.

In Mogadishu, Aadan Mohammed works as a market porter, but there is little business now.

“There are not many goods being imported,” he said. “I and thousands of workers go to the market every day, and some days we spend all day just sitting and talking [because of the lack of work].”

The family came to Mogadishu from a rural part of Baidoa district to the northwest two decades ago when drought wiped out their livestock, and it has been a struggle ever since.

“COVID is like a drought for us,” Mohammed’s wife, Adey, told TNH. The government “just told us to stay home. Now I hate the words ‘stay at home’,” she said.

Their daughter recently got married and moved out of Mogadishu with her new husband. The small income she used to earn selling peanuts – now lost – had been making a big difference to the family’s finances.

The part-time construction work of Yahye Yacqub, who heads our second family in Somalia, has also largely dried up. He’s trying to support five children, but told TNH: Getting just one dollar “is a special day for me”.

Madina, his wife, is a domestic worker, “but since this coronavirus started, some people do not allow us to enter their homes, others don’t have money to pay you,” she explained.

An estimated 40 percent of Somali households are supported by remittances from abroad. But, many in the diaspora are now struggling themselves: Close to 90 percent of remitters surveyed in the UK said they now sent less money home than prior to the pandemic, and a quarter said they sent nothing at all.

Both Somali families said they were trying to economise. Their expenditure bill in August was on average 70 percent less than April, but that was in part because they were buying the cheapest brands and smaller quantities – and with school closures were not paying fees.

“I am a father and I am not able to help my family,” said Yacqub. “This is not a life, but we have nowhere to go to escape [our problems].”

See Madina and Aadan's budgets:

Aadan Mohammed, Labourer

Madina Yacqub, Domestic worker