With both Laurent Gbagbo and Alassane Ouattara laying claim to the presidency, the bitter political divisions in the country have led to worsening violence. While regional and international bodies have repeatedly called on Gbagbo to step down, neither sanctions nor mediation initiatives have come close to breaking the deadlock. Gbagbo and Ouattara head rival administrations, both trying to maximize their resources and isolate the other party. IRIN’s series of revised briefings takes a look at the handling of the crisis by the UN, regional bodies the African Union (AU) and Economic Community of West African States (ECOWAS), western governments, and the European Union (EU), while also looking at the economic, human rights and humanitarian consequences of the breakdown.

The economy - a battle for control

Côte d’Ivoire has lived under two rival administrations since early December. One observer has called it “bicephalism”: two-headedness. Although largely limited to myth and the rarest of medical anomalies when it comes to human beings, such a disruptive condition is now entrenched in Côte d’Ivoire. Two men claiming to be president are embroiled in a ferocious economic tug-of-war as they vie for legitimacy and survival through contradictory edicts and declarations.

The economy - what is at stake?

Côte d’Ivoire has one of the largest economies in sub-Saharan Africa, accounting for 40 percent of GDP in the West African Economic and Monetary Union (UEMOA), with a business infrastructure way superior to those of its neighbours. In a report issued in spring 2008, the US-based Whitaker Group declared: “Côte d’Ivoire is open for business”, noting that “the Ouagadougou Accord and the resultant peace process has given many domestic and foreign investors new con?dence to seize the massive opportunities to do business in a country that is an important hub of West Africa’s regional economy.” The Whitaker Group pointed to developments of a new oil refinery, a reported surge in Indian investment and attempts to turn round an under-performing cotton sector as clears signs of recovery.

Had the elections produced a peaceful outcome, Côte d’Ivoire’s economic prospects would have looked reasonably healthy, with the brake on investor confidence ready to be removed. A growth rate of 3.8 percent was registered in 2009 and there were good predictions for expanding revenues from cocoa and oil exports. The World Bank had embarked on a Country Assistance Programme for 2010-2013, focusing on good governance, infrastructural development, improved exports, agricultural development and a revitalized private sector.

The International Development Association (IDA) had a portfolio of 10 investment projects worth US$737 million ($245 million still to be dispersed). The IMF had agreed to provide $565.7 million under a Poverty Reduction and Growth Facility (PRGF) arrangement, focusing on economic regeneration, while the World Bank and IMF allowed Côte d’Ivoire to qualify for debt relief under the enhanced Heavily Indebted Poor Countries (HIPC) Initiative. Both institutions praised the government’s efforts on poverty reduction and financial management. The debt relief offered, around $3 billion on a total external debt of around $12.8 billion was premised on the successful holding of elections. HIPC status allowed Côte d’Ivoire to enter into debt arrangements with both the Paris Club and London Club. France and the USA also agreed to important debt relief measures.

But encouraging noises from partners and donors were accompanied by warnings that support for recovery depended on political normalization. Since the elections, both the World Bank and IMF have suspended operations, while the political crisis has produced warnings of catastrophic economic consequences both nationally and regionally.

Gbagbo - a scramble for survival

Gbagbo continues to refer to Ouattara and his ministerial team as would-be usurpers, lobbying for survival from the confines of their hotel complex having duped the international community with a fake election victory. Gbagbo and his allies have responded with “business as usual” bravado to mounting criticism abroad, looking to profit from being the power in place, with the apparatus of government at their disposal. Gbagbo’s government has so far shrugged off the freezing of accounts and the introduction of sanctions, playing down the consequences of the financial squeeze and arguing that the economy has already survived eight years of partition and can adapt again.

Amid growing clamour for action against Gbagbo, government spokesman Ahoua Don Mello told reporters: “We are withdrawing money on a daily basis”, playing down criticism from the IMF and others, stressing that Gbagbo was ready to tackle all eventualities and that a Ouattara-led campaign of economic asphyxiation was doomed.

The budget adopted by the Council of Ministers on 13 January and explained by Don Mello the following day on state TV, put state expenditure at FCFA2,907 billion (around $6 billion), a minor increase on the previous year’s figure. Don Mello pledged that salaries would be paid in full, internal and external debts honoured, employment guaranteed, public works projects continued and state services maintained. Don Mello premised Côte d’Ivoire’s continuing economic stability on the expansion of agriculture and mining and increased growth in cocoa revenues.

Briefing reporters in Washington on 3 February, US Ambassador to Côte d’Ivoire Phillip Carter said Gbagbo was taking dangerous, emergency measures to stay afloat: “He has been pirating…. He has been extorting local businesses to pay in advance their taxes, to pay things forward - contracts forward, putting increasing pressure on a variety of companies that are involved in natural resources, be it coffee, cocoa, petroleum, timber, whatever, to pay forward. They’re resisting. And so what we’re seeing there is an effort for him to marshal as many resources as he can to get the money together to meet his payroll - probably to acquire additional weapons, to keep his fight going.”

Ouattara and Soro - leverage from legitimacy

Internationally recognized as president, Ouattara has talked with confidence of Gbagbo running out of time and tactics, saying exports and imports will slump, as will GDP. While a disobedience campaign, calling for strike action, has been followed patchily, Ouattara and his supporters seem confident Gbagbo’s economy will collapse from within as the banks run out of money, the refinery runs out of fuel and cocoa exports stay on the dockside.

Ouattara is a highly experienced financial apparatchik, with deep knowledge of national, regional and international banking institutions and legal mechanisms. His minister of finance, Charles Koffi Diby, has a similar pedigree, having served as president of the Council of Ministers of the UEMOA.

From the beginning of the crisis, Ouattara’s Prime Minister, Guillaume Soro, while openly lobbying for outside military intervention, has also persistently called for his government to be given immediate control of the commanding heights of the economy, warning of severe penalties for banks, corporations and individuals seen as treating with Gbagbo’s discredited administration. Combining diplomatic and financial pressure, while retaining the military option, Soro has talked of getting Gbagbo out “within weeks, not months”. A communiqué issued by Soro on 7 January highlighted the role of economic operators in shoring up the Gbagbo government, listing 16 individuals and eight financial institutions at fault. Soro warned: “Any authorization coming from a person not mandated by government is null and void,” emphasizing that taxes should only be paid to customs officials and tax authorities.

|

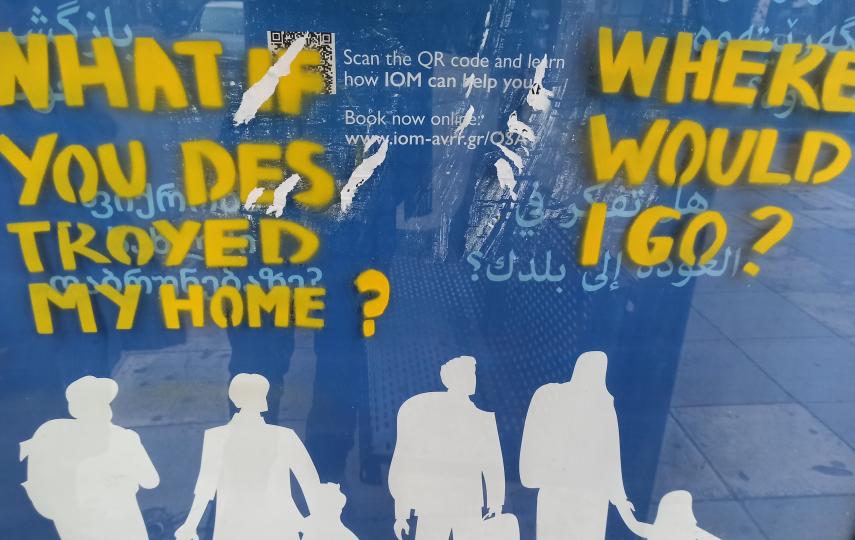

Photo: Monica Mark/IRIN  |

| Small-scale traders struggle on |

On 26 January Gbagbo ordered the seizure of BCEAO branches in Côte d’Ivoire, a move swiftly denounced by Ouattara as “illegitimate and illegal”, who ordered the branches to be closed. BCEAO, now headed by Burkinabe Jean-Baptiste Compaoré on an interim basis, closed its computerized inter-bank compensatory service, so other banks cannot carry out transactions with it.

BCEAO said it would be seeing “appropriate responses to an unprecedented situation”, and apologized to its staff sent home on stand-by.

Meeting in Dakar for an extraordinary meeting on 1 February, the UEMOA Council of Ministers fully backed the BCEAO’s position and said it would be looking at new measures to assure financial liquidity in the region.

One of Gbagbo’s main allies, FPI President Pascal Affi N’Guessan, has warned that Côte d’Ivoire could withdraw from UEMOA, describing his country as both the “spinal column” and “economic lung” of the Union.

The “second Côte d’Ivoire” - the Forces Nouvelles’ economy

As head of the rebel Forces Nouvelles (FN) in the north of the country, Soro stood at the head of an informal state within a state, running a heavily improvised economy with its own taxation system and trade routes, bitterly resented by the central administration in Abidjan, which complained of lost revenues and racketeering as untaxed cocoa, cotton and other commodities left the country.

While both sides have ruled out partition, Ouattara and Soro retain effective control of huge swathes of territory, with easy access to neighbouring states like Mali, Burkina Faso and Guinea. Hesitant attempts were made in the aftermath of the Ouagadougou Accords of March 2007 to establish a joint administration in the north and other areas where the FN had held sway since 2002, with the state sending civil servants back from Abidjan and both sides agreeing on using joint financial mechanisms. But the Group of Experts and others noted serious deficiencies in this process, with the FN reluctant to concede sovereignty in some areas and also wary of declaring assets and allowing the state to regain control of the economy

Independent observers, notably the UN-appointed Group of Experts, criticized the FN for its lack of transparency on economic matters, noting the lack of accountability on taxation, while raising concerns about the illegal export of diamonds and gold and the development of cross-border smuggling networks. Observers say these networks are still in place, with cigarette smuggling still a major source of revenue for senior rebel commanders and their business associates, relying on amenable authorities in neighbouring countries.

Given the decentralized nature of FN territory, with zones assigned to individual commanders, there is still considerable confusion over economic control in much of the territory outside Gbagbo’s jurisdiction and also the extent to which FN senior personnel will fall into line under a Ouattara-led government. The most important gold concession in the country, the Tongon mine, mined by Randgold Resources, is in an area held by FN, close to the border with Mali. Randgold says its mining operations have continued despite the political crisis.

cs/am

This article was produced by IRIN News while it was part of the United Nations Office for the Coordination of Humanitarian Affairs. Please send queries on copyright or liability to the UN. For more information: https://shop.un.org/rights-permissions